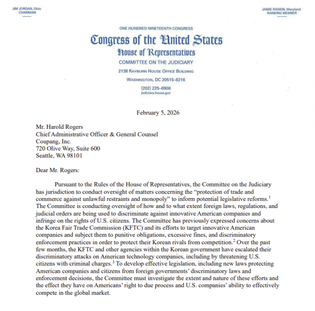

|

| 씨에스윈드. (사진=씨에스윈드) |

[Alpha Biz=(Chicago) Reporter Paul Lee] Sangsangin Securities maintained CSwind's investment opinion 'buy' and target stock price of KRW 83,000. CS Wind's closing price on the 29th is 51,700 won.

Sangsangin Securities said on the 4th, "CSwind's fourth-quarter performance in 2023 was 402 billion won in sales and 34.4 billion won in operating profit, partly below the market consensus (average forecast)."

The positive part is the surplus of the BLADT, which was concerned. Through smooth negotiations with customers, a large-scale surplus was generated due to unit price hikes. Additional non-current revenue is expected during 2024. The negative part is the low tower sales. Except for AMPC, tower sales are about 200 billion won, the lowest level since 2021.

CS Wind is expected to benefit from the growth of the US market. Sangsangin Securities said, "The proportion of VESTAS in U.S. corporations will increase by about 80% in 2024, and profitability is expected to increase due to increased productivity."

Alphabiz Reporter Paul Lee(hoondork1977@alphabiz.co.kr)