|

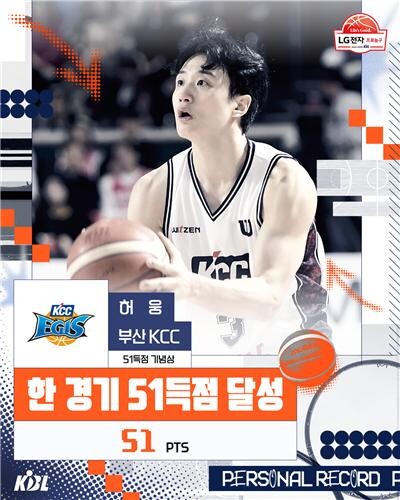

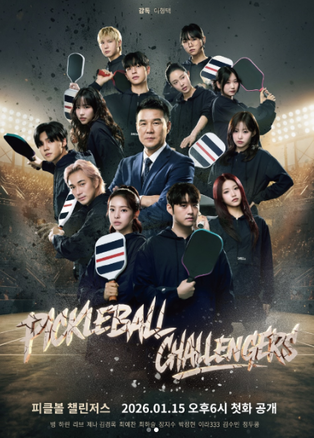

Photo courtesy of Yonhap News |

[Alpha Biz= Paul Lee] Seoul, September 25, 2025 – The maximum fines for Korea’s major banks related to the mis-selling of equity-linked securities (ELS) tied to the Hang Seng China Enterprises Index (H-Index) are now expected to be reduced from an initially estimated KRW 8 trillion to around KRW 5 trillion.

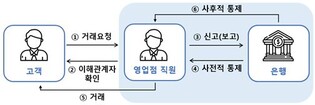

The Financial Services Commission (FSC) recently announced draft amendments to the Financial Consumer Protection Supervisory Regulation, outlining more specific criteria for calculating penalties. Under the new guidelines, fines are adjusted downward if:

The undue profit ratio (sales commission relative to sales volume) is lower than the banks’ return on equity (ROE), or

The undue profit is less than 10% of net income.

Key Figures from Korea’s Four Largest Banks (as of June 30, 2024):

KB Kookmin Bank: undue profit ratio 1.29%

Shinhan Bank: 1.02%

Hana Bank: 1.35%

Woori Bank: 1.50%

By comparison, the industry’s average ROE stood between 8% and 10%, suggesting that all four banks will likely qualify for penalty reductions.

Expected Fine Range

Mid-level penalty rate (30–64%): KRW 2.4 trillion – KRW 5.12 trillion

Low-level penalty rate (1–29%): KRW 800 billion – KRW 2.32 trillion

This means the overall penalty cap could decrease by nearly KRW 3 trillion, alleviating some of the financial burden initially anticipated for the sector.

The FSC emphasized that final fine levels will depend on the seriousness of the violations but noted that the revised formula is designed to better reflect the proportionality between banks’ gains and consumer protection outcomes.

Alphabiz Reporter Paul Lee(hoondork1977@alphabiz.co.kr)