|

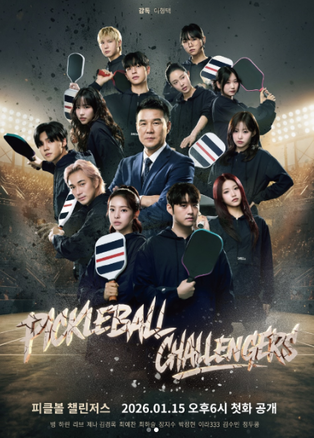

Photo courtesy of Yonhap News |

[Alpha Biz= Paul Lee] SEATTLE – Amazon reported second-quarter results on July 31 that exceeded Wall Street expectations on both earnings and revenue, but issued a weaker-than-expected operating income forecast for Q3, sending shares down more than 7% in after-hours trading.

For Q2 2024, Amazon posted:

Earnings per share (EPS): $1.68 (vs. $1.33 consensus, LSEG)

Revenue: $167.7 billion (vs. $162.09 billion expected), up 13% year-over-year

Key segment highlights:

Amazon Web Services (AWS): $30.87B revenue (+18% YoY, in line with estimates)

Advertising revenue: $15.7B (+23% YoY, beating $14.99B estimate)

Online store revenue: $61.5B (+11% YoY, above $59B forecast)

Third-party seller services: $40.3B (+11% YoY, above $38.7B forecast)

Despite AWS maintaining its status as the world’s No.1 cloud platform, its growth lags rivals: Microsoft Azure grew 39% last quarter, and Google Cloud grew 32%.

For Q3, Amazon guided:

Operating income: $15.5B–$20.5B (midpoint $18.0B vs. $19.48B expected)

Revenue: $174B–$179.5B (10–13% YoY growth; even the low end surpasses $173.1B consensus)

The subdued profit outlook disappointed investors expecting faster payoffs from Amazon’s massive AI investments. The company plans to spend up to $100 billion this year on data centers and software infrastructure to accelerate its AI capabilities.

Amazon’s stock closed the regular session up 1.7% at $234.11, but dropped over 7% in after-hours trading following the earnings release.

알파경제 Paul Lee 특파원(hoondork1977@alphabiz.co.kr)